ALGO Trading Systems use Algorithms

To generate BUY and SELL Signals.

A computer program is programmed to specific trading strategies.

It generates BUY - SELL signals based on these strategies

that are programmed within the algorithms.

Algo Trading Systems take into account anything from technical analysis to very advanced

mathematical calculations. Once the Algo Trading System is completed, traders can take a hands-off approach to trading,

as the computer takes over the trading decisions. It is attractive to traders because it

takes the emotion out of trading, which can frequently impact trading decisions.

Algo Trading uses a computer program that follows a defined set of instructions (an algorithm)

to generate a BUY or SELL signal. Algo Trading makes trading

more systematic by ruling out the impact of human emotions on trading activities.

Using complicated instructions, a computer program will automatically monitor the market and signal the BUY or SELL signals

when the defined conditions are met. The most common Algo Trading strategies follow stochastics, moving averages,

and technical indicators. These are the simplest strategies to implement because these strategies do not involve making

any predictions or price forecasts.

Advantages of ALGO Trading Systems

One of the main advantages of Algo Trading Systems is the absence of emotion. Removing emotions

from trading helps the trader not make irrational decisions and stay true to their trading system.

Traders also won't second guess themselves. It enforces discipline at all times, which is especially a key in times of volatility.

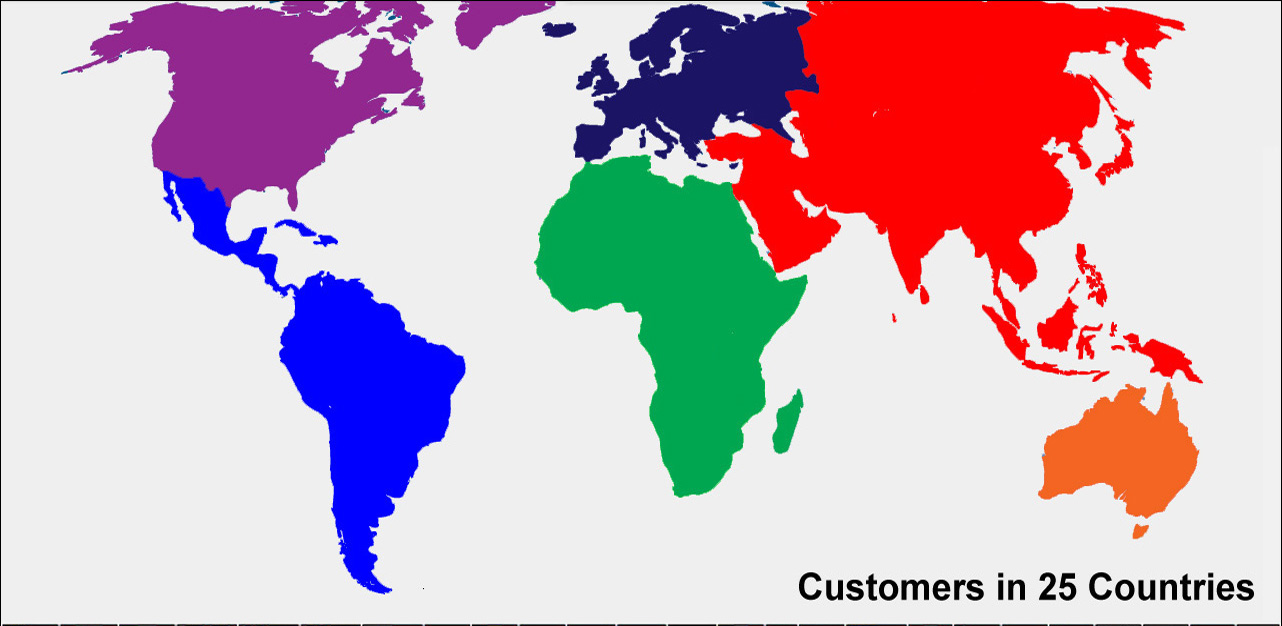

Algo Trading is widely used by investment banks, pension funds, mutual funds, and hedge funds.

However, it is also available to private traders using computers and retail trading systems.

There are 2-Groups of Traders

|

FAQ

FAQ

ABOUT

ABOUT